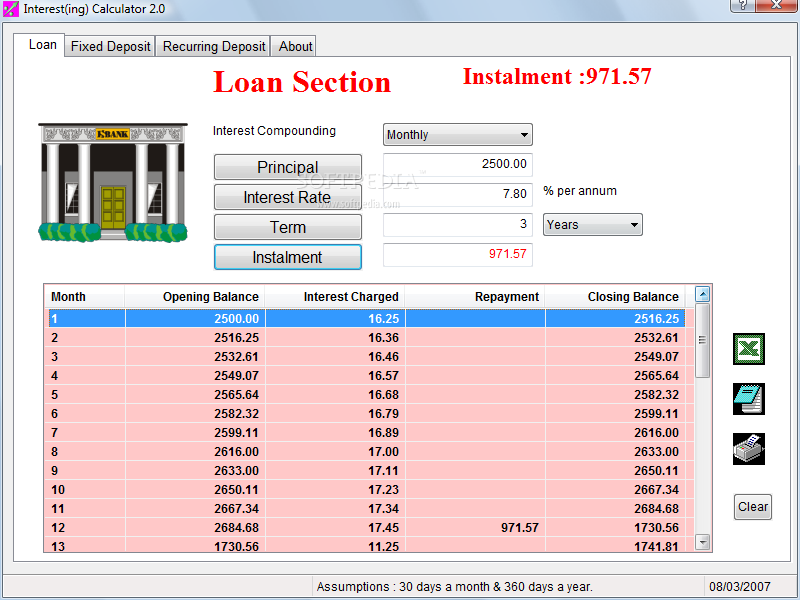

Buying a home is just one of the finest expenditures you might make, and also as the worth of your property increases, you can utilize one increasing money without the need to sell the brand new family.

However, which one is right for you? On this page, i speak about these facts, the way they really works, and circumstances where it’s possible to become a much better selection than additional.

Reverse Mortgage Concepts

A home Guarantee Conversion Mortgage (HECM), known as an opposing mortgage, are financing solution designed to help residents move their residence guarantee into bucks. When you take out good HECM contrary financial, the current mortgage could be repaid in full, which means you no more need to make regular monthly obligations with the their unique loan.

An opposite mortgage permits home owners to convert the remaining loan harmony on the cash. Money is going to be gotten in lots of ways, instance a lump sum payment, equivalent monthly installments, or a contrary mortgage credit line. As an alternative, you could potentially opt for a combination of such possibilities.

A contrary home mortgage is actually paid when the house is marketed, in the event that home is no more made use of while payday loans Scottsboro the no. 1 household of homeowner, or if the past homeowner becomes deceased. Continue reading