A great CIBIL Get was a personal credit rating that shows an effective borrower’s credit worthiness. The latest rating selections anywhere between 3 hundred and 900. The greater the rating, greatest is the chance to get an unsecured loan recognition. A personal loan to own CIBIL Get off five-hundred is hard so you can score. Banks and NBFCs prefer CIBIL Score out of 750 and you may a lot more than in order to accept an unsecured loan. Although not, several loan providers could possibly get approve the borrowed funds having score of 550, however, within a higher level of interest, fees, and fees.

About below post, we’ll talk about on what a consumer loan try, CIBIL Rating 550, consumer loan getting CIBIL Get away from 550, issues accountable for the lowest credit score, tips alter your CIBIL Rating, drawbacks off trying to get a loan having lowest CIBIL Rating, and you may Frequently asked questions.

What is a personal bank loan?

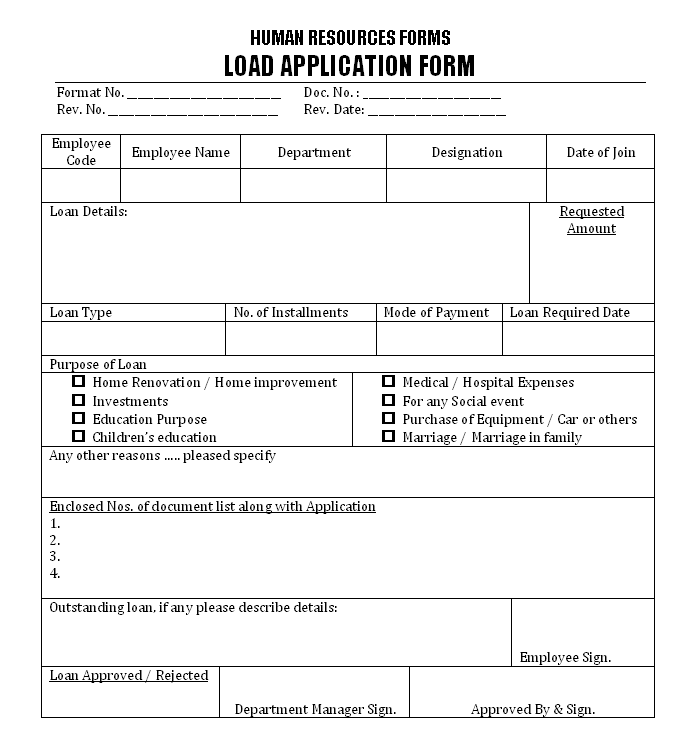

An unsecured loan is actually an unsecured loan. It is an useful mortgage no restriction on the prevent fool around with. Ergo, you can make use of the mortgage amount when it comes to financial you need. Multiple individuals need so it security-totally free mortgage in order to satisfy its crisis means like medical contingency, home improvement/repair, educational expenses of children, big-admission purchase, travel, marriage, plus.

A) Qualification Standards

Becoming a personal bank loan, banking institutions and you will NBFCs purely evaluate your credit report, income, existing economic obligations, employment records, etcetera, to determine whether to lend or otherwise not. As the financial cannot capture people defense to incorporate financing, it product reviews your financial status.

- You might obtain anywhere between Rs. 1 lakh and you can Rs. 1 crore.

- It financing try especially for salaried category. Yet not, several loan providers get continue this service membership so you’re https://simplycashadvance.net/payday-loans-al/ able to worry about-operating some one as well.

- CIBIL Get regarding 750+ is preferred so you’re able to get this mortgage.

B) Personal bank loan for CIBIL Rating from 550

Not all loan providers might provide a personal loan for CIBIL rating off 550. For the reason that, 550 isnt deserving enough a credit history to include a keen consumer loan. You need to check most of the offered has the benefit of off lenders who give lower credit score personal loanpare the interest cost, fees, and charge, as well as most other fine print.

Just what Should you decide Understand CIBIL Rating 550?

Your credit score can alter centered on your financial deals such as for instance as the EMI money, bank card expenses payments, missed/put-off costs, closing of membership, and. For this reason, your very own credit score isnt a static figure. It may boost and you can decrease with each of your told you purchases. The credit score 550 indicates your financial actions need an update. You made several normal money, however, defaulted/skipped multiple.

- Whatsoever, your credit score reflects your borrowing from the bank behavior. Its one of many important symptoms to have loan providers to determine your own creditworthiness.

- Centered on so it get, the lenders have a tendency to propose to provide you that loan or otherwise not. Very, an unsecured loan having a beneficial CIBIL Rating off 550 is unquestionably difficult to get.

- not, lenders giving funds on a low credit score create exists. The eye relevant is even if to the high top.

- Therefore, to switch their CIBIL score, you ought to discipline debt behaviour and you may pay the EMIs/expenses on time. Gradually, your credit score will advance.

Is it possible you Rating a personal loan for CIBIL Score off 550?

A get away from 550 is not enough to need an individual financing out of a respected lender otherwise NBFC. The newest CIBIL Rating 550 suggests that you have made a number of problems down the line whenever addressing borrowing, causing a decreased get. To possess a lender, a reduced CIBIL rating are a warning sign. This may dissuade the loan-provider off thinking you that have borrowing. Really banking institutions need you to has at least credit rating regarding 750 to adopt a loan application.